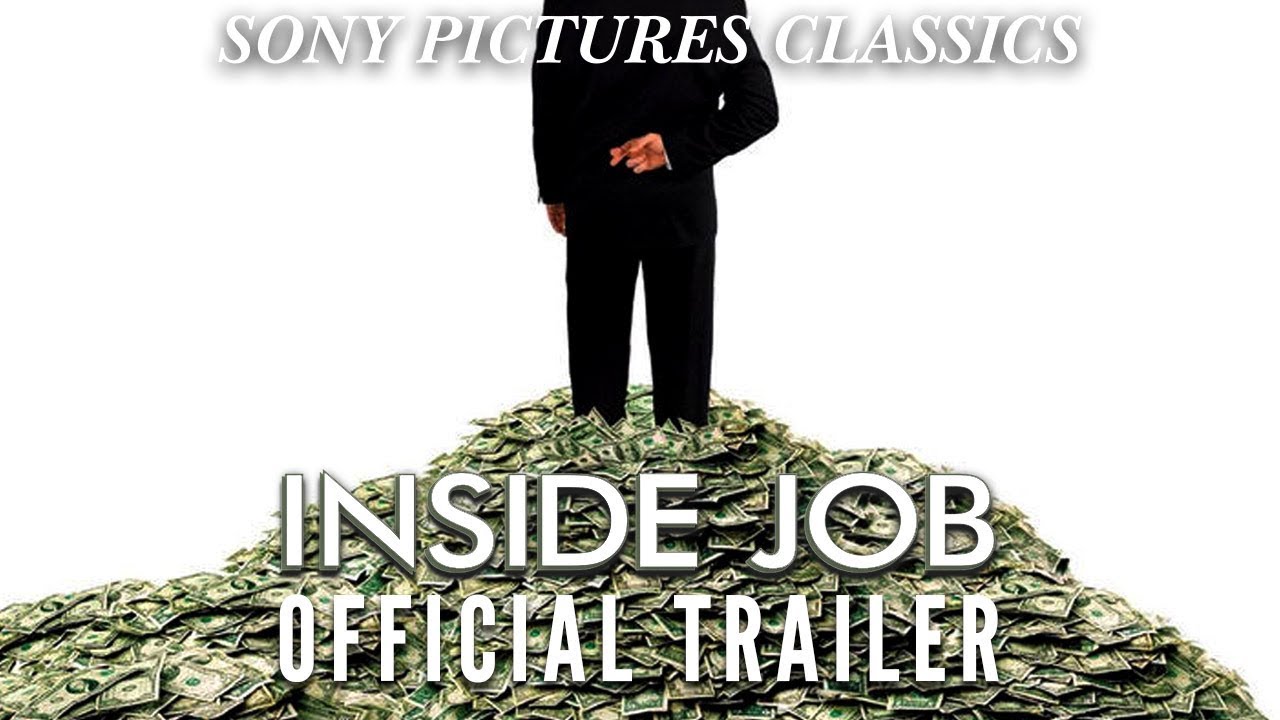

Inside Job

As he did with the occupation of Iraq in No End in Sight, Charles Ferguson shines a light on the global financial crisis in Inside Job.

Accompanied by narration from Matt Damon, Ferguson begins and ends in Iceland, a flourishing country that gave American-style banking a try - and paid the price.

Then he looks at the spectacular rise and cataclysmic fall of deregulation in the United States. Unlike Alex Gibney's fiscal films, Enron: The Smartest Guys in the Room and Casino Jack, Ferguson builds his narrative around dozens of players, interviewing authors, bank managers, government ministers, and even a psychotherapist, who speaks to a culture that encourages Gordon Gekko-like behavior, but the number of those who declined to comment, like Alan Greenspan, is even larger.

Though the director isn't as combative as Michael Moore, he asks tough questions and elicits squirms from several participants, notably former Treasury secretary David McCormick and Columbia dean Glenn Hubbard, George W. Bush's economic adviser.

Their reactions are understandable, since the borders between Wall Street, Washington, and the Ivy League dissolved years ago; it's hard to know who to trust when conflicts of interest run rampant.

If Ferguson takes Reagan and Bush to task for tax cuts that benefit the wealthy, he criticizes Clinton for encouraging derivatives and Obama for failing to deliver on the promise of reform. And in the category of unlikely heroes: former governor Eliot Spitzer, who fought against fraud as New York's attorney general (he's the subject of Gibney's documentary Client 9).

Here's something radical: how about a cap on how much a person can own? Say 10 million (think that's enough to get by on)? And how about prosecuting the cheaters?

Let's face it- you don't need that much capital for to be an incentive to run a successful business. And bankers (who should act in good faith as vault keepers, not barons) don't really do that great of a service to the public to deserve much besides an average salary anyway. Do they? The problem is that our government has allowed the sob's to take over. They make the money now. And they make the debts that enslave us.

Do you find my idea draconian, undemocratic, utopian, or dangerous? Let me ask this: what is more dangerous than a whole society in debt, unable to go to university, unable to own a home or get a good job, worse off than their parents, disillusioned, and disintegrating into menial jobs that they're overqualified for? Is this the society we want? Do we want to go backwards? I don't.

Free ownership of obscene amounts of capital and unlimited access to creating loans out of thin air are not sacred cows. The Bill of Rights is, and it is being trounced upon. I am for democracy with intelligent regulation. I am against robber barons. I am for a very high tech and very low currency society. I am for a new generation concerned with science, cleaning this mess up, and living healthy lives in mind, spirit, and body. Am I just a utopian idealist or is someone else with me on this?

this movie is garbage and completely manipulative. it does not explain the crisis in accurate detail at all... secondly its madoff, not maddock. thirdly, why aren't the rating agencies or fannie mae and freddie mac being held responsible?? they didn't do their homework at all and no one got any consequences. trust me, i agree and am frustrated that CEOs that took excessive risk at failing banks (i.e. dick fuld of lehman for example), got astronomical golden parachutes while the rest of the firm saw their stock and value plummet to nothing. attacking solely the investment banks though is asinine and does not add up. there were many other players in the mess. why aren't countrywide or indymac among others involved at likewise predatory lending firms being held accountable? why did they get off easy, only for the banks that swallowed them to now have to deal with the legal troubles from the companies acquired (JPM, BAC, etc.)? these people need to do their homework and hold ALL accountable, not just the bankers (I am an accountant for the record so I have no bias in this, just think the media's whole thought process on who is responsible needs to be revised). the fact that these companies gave NINJA loans (no income, no job or assets) to people with negatively amortized debt makes absolutely no sense and is pretty much white collar crime against the middle and lower classes to a tee and no one says shit... funny how that escaped the media... also, wtf does the beginning with the bankers/traders and strippers have to do with anything in the movie??? its a bs scheme to get you to question their credibility before the movie hardly begins, which is horse **** and doesn't let the viewer make its own opinions. DONT BELIEVE EVERYTHING IN THIS MOVIE!

Start a petition on change.org to pass legislation to hold these crooks accountable for the largest Ponzi scheme ever. They should not be working for the US Gov or anything to do with finances/banking, etc. They should be in jail for life....like Maddock.

The biggest heist in world history and almost all of the guys who did it walk around free.

i have been writing about the impending financial crisis for years. i might have been able to add some real juicy first hand details. in the summer of 2007 one of my sons caled to tell me that there was a major problem with a firm called sentinel capital. commodity firms used sentinel because they paid slightly more than vanguard. he was, and still is , a financial officer. but my best acount concerns my two older sons who are bankruptcy attorneys in nj. i was trying to get anyone to visit my son's house. the basement had become a storage facility for clients files. i stopped counting plastic containers when i reached 150-200, now i just pile the files on the basement floor. it is a sight to be seen . would have looked great on tv, but there were no takers. each file, of course, represents an individual who has filed either chapt 7 or13. even in the electronic age the attorney is required to keep a paper file for seven years. thousands upon thousands of files indicates thousands upon thousands of problems for mortgage and credit card companies. they knew there was a major problem. but everyone, except the attorneys believe it or not, was making a lot of money. they knew brokers who were earning 500k per year, selling house after house to individuals who either were less than honest or financially inept. last sunday , i carried over 200 files from the upstairs office to the basement. this does not include the hundreds of files that are still in their office or at my older son's house. i am sorry i was never contacted. both attorneys would have been happy to supply information. my middle son refers to me as filemaster

If your mother asked you where to invest her money, what would you tell her? This was the question posed to Jim O’Neill, chairman of Goldman Sachs Asset Management, on Friday.

After rambling something about India perhaps doing a little better than expected Mr. O’Neill said that he is still in the camp that America’s “choppy” markets will probably recover toward the end of this year.

Not very confidence-inspiring from the chief investment strategist at one of America’s most prestigious banks.

But this is the state of the world today. Nothing is safe, and even the brightest financial minds don’t have answers to our most pressing problems.

America’s saving grace is that much of the world’s focus is still on the problems in Europe. While that lasts, attention is distracted from America’s equally precarious financial condition. But Europe is at least dealing with its financial issues. All America’s leaders can seem to do is kick the can down the road.

So where is the best place to put your money?

Not betting on American consumers, according to O’Neill. Even though Europe is making the headlines, America’s weak employment picture poses a bigger threat to global markets than the European debt crisis, according to O’Neill. There is a “lack of self confidence” in corporate America, he said.

For those who missed it, weekly jobless claims for the most recent reporting period stood at 377,000, which is uncomfortably close to the 400,000 mark that is often considered the red line for an “improving economy.” The jobless rate rose to 8.2 percent.

With employment down, it is hard to count on consumers to save the economy. “If people don’t have cash and they have limited access to credit, than there’s just so much that they can run up in terms of bills,” says Jerry Webman, chief economist at Oppenheimer Funds.

Webman believes that people just have too much debt and it will take years to fix. “There’s a long-term unwind (of household debt paying) … and until we’re through that, we’re not going to see a rapid expansion of consumption,” he says.

But unless people spend more, why would America’s debt-based, consumption-oriented economy create more jobs? Who are businesses going to sell more stuff too? Americans already have too much stuff—and have the credit card bills to prove it.

So what about investing in commodities?

What about oil? Currently, Brent crude (oil sold to Europe) trades at $90 per barrel. It has fallen a whopping 30 percent from a $128 peak earlier this year. Traders say there is a glut and that demand destruction from a slowing global economy is outpacing the constraints of “peak oil” geology. There is talk of ocean supertankers lining up off Britain’s coast as giant floating storage facilities. In America, new horizontal drilling and fracking techniques are boosting domestic production. Plus, Canadian oil sands crude is currently trapped in North America with Texas refineries their only option. Barring an outbreak of war in the Middle East, oil doesn’t look like a good short-term investment.

What about investing in industrial metals like copper, zinc, lead and aluminum? Probably not a great idea either. China uses 42 percent of the world’s production of these commodities. If China slows, demand will plummet, and prices will crater.

And China appears to be headed for a hard landing.

Famous economic analyst Marc Faber says people need to prepare for a global recession, probably hitting late this year or early 2013. It is “100 percent” certain, he said in a recent interview. There is a “meaningful slowdown in India and China” that many investors are missing due to all the focus on Greece and Spain. But it will be global, he said.

What about investing in food? Beyond what it takes to fill up your pantry, stockpiling food may not be a good investment either. Coffee, orange juice, sugar: When people are focused on paying down debt—or worse, just trying to keep the electricity and water turned on—these treats get cut. Even staples such as wheat and corn may fall in price.

How about investing in precious metals?

Gold has been a roller coaster. In 2011 it hit an all-time high of $1,895 per ounce. It started 2012 back down at $1,600 per ounce before shooting back up to $1,772 in February, then back down to $1,548 in May, and then back up to around $1,583 where it is today.

The Aden Forecast has two of the best gold market analysts out there. And they seem to be cautious about gold—at least over the short term. “Increasingly, the similarities to 2008 are becoming almost eerie. We may be wrong, but the markets are poised for this and while we don’t know what the trigger will be, it could be almost anything,” they wrote in a recent letter.

“Currently, our gut feel is that if an accident is coming, it’ll likely happen this year,” they warn (emphasis added).

When the markets crashed in 2008, gold and silver fell hard too, even though they also were among the first to recover.

“Again, it could be a wild card. One example is the explosion of the derivatives markets. … The popularity of derivatives has skyrocketed within the financial industry. In the past 12 years, derivatives have grown 10 times faster than world gdp to the tune of $200 trillion for U.S. banks, which is three times the world’s gdp! This is a reckless accident waiting to happen and JP Morgan’s $2 billion loss this month may have been the tip of the iceberg” (ibid).

As the Aden Forecast brings out, America’s financial sector is no place to invest money either. After four years and trillions in taxpayer loans, many banks have still not been able to clean up their balance sheets. On Thursday, Standard & Poor’s ratings agency downgraded JP Morgan Chase, Morgan Stanley, Goldman Sachs, Bank of America and Citigroup—America’s five biggest investment banks.

Two of them, Citigroup and Bank of America, got cut to Baa2—which is just two notches above “junk” status. Four years ago, few people would have suggested that Bank of America was “junk”—but four years ago, Lehman Brothers, Bear Stearns and Wachovia were still alive and prospering. That is how broken America’s banking system is.

The downgrades will cost the banks billions in higher borrowing costs, which will make them less profitable, which could lead to further downgrades. Not a pretty cycle.

Plus, the bank’s business model is broken. It relies on giving out loans to consumers. But in this crummy economy, the only people who want to borrow money are the people you don’t want to lend money to.

So scratch the banking sector as a good investment.

How about a house? With more and more students graduating with gargantuan debt, with an aging baby boomer demographic retiring with most of their money tied up in their houses, and with banks overloaded with foreclosed homes to dispose of—real estate is a dud too. Plus, interest rates are at historic lows. Although this lets more people buy houses now, when rates rise, the supply of buyers will shrink—and house prices will fall. Many people buying houses now may be buying ball-and-chains. The banks know this, and the only reason they are even giving out mortgages is because they sell them on to government-owned Fannie Mae and Freddie Mac.

So, scratch investing in anything related to consumer products, stocks, commodities, many foodstuffs, precious metals, the banking sector and real estate.

Not much left.

But what about government bonds and the dollar?

Many analysts say this is the only safe investment left. They have plenty of company. The dollar has firmed in value and interest rates have plunged as investors have piled into government treasuries. And investing in the dollar might temporarily be a safer investment. But as was mentioned above, America’s biggest asset is currently that it is not Europe—even though strangely, by several measures, it is worse off financially.

At some point soon, Europe’s issues will be resolved (read this article to see how). At that point, the dollar and U.S. treasuries will be the worst investment ever—and it will be the one that will cost investors the most money ever.

America’s economy is hanging together by duct tape and silicon. Politicians fight over cutting billions and overspend by trillions. Politicians borrow from Japan and China and the Federal Reserve makes up the rest by printing money. The debt just grows and grows.

As I told my son, when economies were small and local, money circulated and remained in the vicinity. Once regions threw open their doors and allowed every dirty beast to enter, it was only a matter of time. Protecting oneself is not just about stopping violence, it is about protecting your community, workplace, and everything else you care about. I believe the culprits coined it as "PROTECTIONISM".

Yet most Americans filled themselves full and figured someone else would take care of it for them. I cowered as well for years even though I saw a big problem coming.

Fortunately for me, I was too poor to get a bank loan, so I bought a modest piece of land for cash, and built a small home at a slow rate as work came and went. I slept in my camper, tents, and in my bathroom, the first finished room. I own that damn thing!

Getting down to basics was my saving grace. I learned to lose the desire for things out of my budget and bided my time. With several college degrees, I saw that survival was not a subject I had studied well enough.

You can't imagine how overwhelmed I am to see so MANY people now facing that same thing I went through. I understand most acutely and I cry about it.

By the way, I'm now in graduate school studying Union Leadership and Administration. WHY? Real work, real people, real problems. And I've had a good deal of time to sort it all out. I've seen no other groups ever even trying to make justice a priority.

It's ironic because my Bachelor of Science is in Supervision, a tract that I had once planned to carry to the level of CEO. Now I send a warning to the CEO's. I'm on your trail so LOOK OUT!

A devastating exposure of US politics and economics. My heart goes out to the ordinary american citizen,Republican or Democrat the president may be, but the real power is with Goldman Sachs (who got bigger and richer at the end of the collapse). I was left with the most uncomfortable feeling that the whole thing happened by design. How on earth do the people of that country take back their power of governance

The film presents the idea that corruption on Wall Street brought the system down and also corrupted politics. And this corruption persists.

It fails to address the real problem: the expansion of the money supply by the FED.

Why was there so much money pumping up these Wall Street firms and thus giving them the means to influence and corrupt Washington ?

The solution is to abolish the Fed. Without sound money other bubbles will happen despite regulations.

Looks to me like we have two options: declare a global year of the jubilee or prepare for WW3. Hopefully, the latter hasn't already begun.

Why do ordinary Americans earn less than one percent when they try to save money in a bank, while the executives earn tens of millions even when they need a government bail out?

Why do ordinary Americans earn less than one percent interest if they try to save money in one of these banks? Yet, the executives earn hundreds of millions even when the banks need a bail out.

Why do ordinary Americans earn less than 1% interest when they put money in a savings account....

Can Someone answer this question for me if Bush gave the banks 800trillions and Obama gave 700trillion to pay off the bad mortgages. Does that mean my house belong to me and i owe the banks nothing because they both paid my house off for me

I'm not enraged by this. I'm inspired

If we truly had deregulation, then these companies would have been allowed to fail. Other firms would have been able to step up - like the firm I work for - and purchase the assets of the failed banks and fire the failed executives. The biggest regulator in the U.S. is the Fed. A private bank that has been granted a monopoly over the banking industry. Once Goldman and other brokers were able to be classified as banks, then the Fed could step in and bail them out. Notice how Bear Stearns was not bailed out ... they were not allowed to be a bank. Deregulation is a misnomer, regulations/laws are designed to reduce competition by allowing firms to create barriers to entry (with the assistance of the gov't) and the big firms know that if they fail, then they will get bailed out. There are plenty of regulations on the books ... that are not enforced ... fraud is illegal ... theft is illegal ... we don't need another regulation that would "prevent" stealing. I could not believe what I heard in the final minutes "for decades out financial institutions were stable and safe"??!?!?! really?

Wall street is really a small player when compared to the Fed. Why would the fed step in to salvage a firm before it goes belly up .. when they can get it on sale when it fails? The Fed should be audited.

Don't ge tme wrong ... the facts are the facts. what took place can not be denied. I just think the real problem is who controls the money supply.

Can anyone tell me why labor force wage in Uk or US higher than in China or India ?

I have never seen anything that was less of a slanted towards a political bias. Every American regardless of their political bent must see this factual film. It is imperative that the general public know the reason why and who participated in this terrible rip off of the taxpayers, both Republicans and Democrats.

Let us all come together in a unified body to take control away from those who would be our masters. I served my country in WWII and I will volunteer again to defeat this internal threat to all that is good about our country.

this is a masterful exposition of the setup, flight & crash of the speculators and their creators in government, in mega-business, in academia - hell, they're all in business with each other.

this doc - inside job

frontline - the warning

frontline - inside the meltdown

this site - the fall of lehman bros.

together give a fairly comprehensive view of things - but 'inside job' is a one-stop shop, going back to the roots of the crisis.

"the pumps don't work 'cause the vandals stole the handles" dylan '66

@cezy.... What drug are you on? I want some! I think what the film is trying to say is that the powers that be are absolutly corrupt! they for sure don't have me or you or the entire working class of the world in mind!!!

While I do agree with man of the points made in this documentary, I do not like its total lack of obectivity and the constant use of emotional appeal. The physicists who created derivatives and other financial instruments had good intentions, and not all bankers are stereotyped cokeheads who go with prostitutes! It's very easy to create an enemy through anger (bankers' bonuses) and it's not very different from government propaganda preying on fear (terrorists).

Most (non Harvard, I shall say) economists are doing their best to overcome what they call moral hazard and the general public calls fraud/corruption/theft ect. but the problem is not easily solved. And we have a responsibility too, as consumers, to avoid wasting money and resources, and as human beings to be informed and use our critical thinking.

War and econimics go hand in hand it the consumerism of the people in general and americans in particular which is the responsible for the killings all around the world and now this mess has become so toxic that americans themselves are in a viscious circle of debts and slavery to the banks.

'Greed is good'

Nice guys finish last'

'Savings is anti american way of life'

'Putting the money back into the economy'

Consumerism aptly supplemented by advertising has rob the world and its citizen of peace.

'The only reason a great many American families don't own an elephant is that they have never been offered an elephant for a dollar down and easy

weekly payments'.

The gap in US economy is between what we have and what we think we ought to have - and that is a moral problem, not an economic one.

Power corrupts. Absolute power corrupts absolutely

I haven't watched his video yet, but from my memory, the first thing that told us something was wrong with the financial markets was the fall of Enron. If the people responsible were hung in the public square... like they deserved... I bet a lot of the crap that is happening wouldn't be happening like it is.

If you steal hundreds or thousands of people's pensions... you deserve a punishment that fits the crime.

Off with their heads!

WOW. Greed at it's unbridled pinnacle. Unbelievable - I wish. But it is not just financial sectors. How about Enron and BP?