I Want The Earth (plus 5%)

The sole purpose of this story is to explain the simple maths of reality and the current Banking System – that is - 100 plus NOTHING does NOT equal 105 – and that charging interest on something that is created out of nothing, makes it impossible to repay, giving great power to those who do create money out of nothing - ie the Banks. This story was written by Larry Hannigan in 1971 and uses a fictional character (Fabian) in the narrative.

The sole purpose of this story is to explain the simple maths of reality and the current Banking System – that is - 100 plus NOTHING does NOT equal 105 – and that charging interest on something that is created out of nothing, makes it impossible to repay, giving great power to those who do create money out of nothing - ie the Banks. This story was written by Larry Hannigan in 1971 and uses a fictional character (Fabian) in the narrative.

Money is NOT a commodity, it is a system of debit-credit bookkeeping - nothing more. Banks create credit. It is a mistake to suppose that bank credit is created to any extent by the payment of money into the banks. A loan made by a bank is a clear addition to the amount of money in the community.

The issue which has swept down the centuries and which will have to be fought sooner or later is the People v. The Banks.

None of our problems will disappear until we correct the creation, supply and circulation of money. Once the money problem is solved, everything else will fall into place.

please tell me about the character of the fabian in this doc?

In my opinion, as some of you cite, it is all about capitalism which is equal to capital + interest (+/-) + system (+/-) + market (+/-); +/- on both hands.

So you quote fake religion to challenge fake money. Nice.

all money is created as loans. the principle will always be less than th principle plus interest. p<p+I The principle is our TOTAL money supply. Yes, one can get out of debt, but collectively we can not. Don't listen to the comments about reserve requirements and savings and taxes. That's all stupid econ 101 stuff. Where do savings and bank reserves come from? They come from someone's loan principle. This documentary is accurate. It is that simple. If we all paid back all our loans. we would have no money, and we would still owe the interest. When a loan is repaid, that principle (money supply) disappears. We have to keep borrowing or we won't have any money. Governments can create money and spend it into circulation. Section 8 of the constitution: can coin money, regulate the value........ Now before you say anything, read that sentence again. Coin is a verb not a noun. Coin:meaning to create.

This documentary has been brought up in the scope of money and credit system in a country. The story quote explains well but the summary is not worth it, it should have had more clear examples and detailed perspectives. That is what is lacking everything else is stated well.

Like posts from Gobgob and Esco. I know that something doesnt hold in the story. First if economy is growing and population is growing i see no problem in repaying extra interest. Because new added value is being created. In other case, if it after many buy-sell rounds ends up as only paper value, where the markets have pumped the price beyond the fundamentals - every 7-10 years we have an economic colldown where non existant value is erased. Another story is inflation - goverment throws money at rate od 10% increase per year, and suddenly you make profit just by being in debt. And, as was said, banks have many costs also, as paying interest to people who deposited money, paying operational costs - and most critical - default by nonpaying debtors. This money is simply destroyed and banks have losses on their balance sheet. In this documentary everything is oversimplified.

No one is powerless to reduce this problem.

Start by barter .. no need to barter everything just do a little bartering.

As times get tougher : increase barter and deal only with those that you trust to barter back in kind fairly with no intent to force the use of money into the trade.

The more people barter the less goods and services the banks have to control with their "money" soon you will note taxes trying to collect by looking at barter trading history .. this is of course easy enough to deal with by under value of the trade and or loss of the historical records of transactions or by merely appeasement by using a small amount to partake in the "money" .

Small as these actions seem the more people that move into sheltered trade systems will help diversify and protect more rights then marching into parliament demanding action will ever do.

in capitalism the value of a commodity is measured by the socially necessary labour time it takes to produce it. All efficiencies lower the value of commodities and a profitability crisis arises. Profit or surplus value is extracted at the point of production when the owner of the means of production pays for the commodity labour power a wage that is less than the value that his labour power is able to produce. That is the inherent exploitative nature of capitalist social relations and where pithy sayings such as "time is money" derive from. So the system is both "immoral" and irrational and points to the need to socialize ownership on either ground.

Everyone living where the soil has clay content needs to learn to build a combination of cob home and earth ship home. This is really critical.

Even people with existing homes should learn to do this and make themselves a new place to live. Cob homes are supposed to be some of the hottest selling real estate in Scotland. The best part is that they do not need to be heated or cooled. They are comparatively cheap to build, resistant to earthquakes, require little maintenance, etc.

An aristocratic affliction here is that some want to laboratory work words, instead of interpreting the overall picture. Waste not your time to explain to those who have decided to not understand. Knowing the cause is often half the solution. The craving has enslaved our intellect and for far too long.

Very very good. It makes it simple to learn why the whole world and its people are slaves to the banks.

great great doc. why most of what is been mentioned are true. not everything is.. for me i think the number 1 problem with the whole money economics thing, is greed and more fu*k*ing greed. from the bankers right down the the poor man sitting at the street corner...

Great doco. Sadly blemished with too many biblical references. Still well worth watching.

When will we the people finally say enough is enough? People have been conditioned to ridicule anyone who speaks out against the system. This is not a conspiracy theory. The info is all out there and it has all been documented. We are all being screwed over and it does not have to be this way.

With the debt crisis in the USA, more trouble is only over the horizon and with no plan to solve the issue the inevitable will occur. What will it take to start a revolution?

Why not just call Fabian Mayer Amschel Bauer Rothschild and just call this a biographical documentary, this documentary basically chronicle's Mayer's rise to power, Fabian is Mayer Rothschild.

Marvelous Documentary!

Should be shown in elementary and high schools and colleges for that matter in the U.S. and around the rest of the world. Even and especially in 3rd world countries in all languages.

Education or better yet, knowledge is the greatest threat to this and any other satanic system. Just as light kills the vampire. Knowledge destroys the most hideous in our world.

I do not intend to offense anyone, in contrary, I want to motivate all to boycott all banks just as Muslims do (the only community that is still complying to what has been asked in Bible and Qur'an!). This video should be shared (it is a great video!) as not even 1 percent of the wide population knows the world they live on and reasons of religions existence!

Beware for opinions like of this one by gobgod...

Sounds like the prime minister of my country. Very articulated to perpetuate the "status quo". Are you an economist? I guess you're an Hayek fan, aren't you? Well, go back to your library and read all the books you didn't and then comeback and watch this movie again. Or, once you're on the banking/finance "world" you're one of those whose job is profiting from pressing buttons and watching numbers rolling down a screen? Where's the added-value on that, mister economist?

Make no mistake, the International Monetary System has a parasite of the capitalism itself is the Root Of All Evil! And yes. It is in private hands! Just a few of them... Or who do you think those nice institutions like IMF, IBRD, ECB, FEDRESERV, BIS, BOV, and so on, really are? Filantropic institutions democraticly rulled by the people?!

If we want to excell has a species and stay in this planet for a few more years we must TAKE control of our destiny.

If you believe this, you should start a bank. Sounds like it's a guaranteed way to get rich.

As an economist who works in banking/finance, I'd like to say that this story is not an account of the real world. The premise that wealth is a zero-sum game is nonsense. Say there is money but no bank: if it costs me $5 to make a widget and I sell it to you for $10, have I reduced your wealth? No, not if it was worth $15 to you! According to this video, any labor surcharge would reduce GDP. How, in such a model, could GDP ever grow? GDP growth would require more money to be printed. Therein lies the problem. The author has no understanding of the difference between real and nominal GDP, nor an understanding of value added.

Liquidity vs solvency is another big problem for the video, as is an understanding of how the money multiplier actually works. Sure, banks can turn $100 into $900, but they have a cost for liquidity at each step of the process. You pay 3% to the original $100 depositor, and then loan someone $90 from that $100. Then another bank pays 3% on the $90 deposit that allows an $81 loan, etc, etc. The money is paying 3% at each step, so banks that earn 45% on all their loans pay 27% to depositors. The banks then pay employees to process all those loans, other employees and advertising agencies to bring those loans to the door, etc. Traditional banks end up making the same long-run average return on equity as most every other competitive industry.

Dumb.

True to a certain extend, but seriously exaggerated in certain parts; esp in minute 32,38,39 and 43~

That was incredibly entertaining. And very likely an accurate depiction of what really is going on up there. Definitely recommended for all ages!

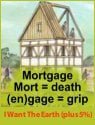

Well, I only made it through the first half. Not the worst doc, but it is a topic that has already been beaten to death time and time again on this and other sites. Also, as I saw someone already mention on here, mortgage doesn't at all mean "deathgrip", it kind of hurts a film's credibility when they alter facts. As the person mentioned, it means pledge, kind of like a collateral.

again facts are infront of you...

i am CIMA and CIMA Islamic Finance qualified...

its upto you to keep up with the same system or wake up....

Sadly this documentary is nonsence! Interest rates are not a big deal. Substract taxes and the inflation and you will see that the interests aren't the true problem. Unfair tax systems are and the imbalance of money truely is!

The "death grip" is not created by the bankers, realtors, interest rates, loans, commisions. These are all just different vehicles chasing wealth. The "death grip" is the very human trait of greed. Anything beyond "3 squares and a cot" is greed which pretty much includes all of us.

Something is missing here: velocity of money. Otherwise we can use the same logic for profit. Profit or margin is the same concept as interest. For example, I bought a good for 10 EUR and then sold it but with 5 EUR profit (15 EUR). But I let in the system only 10, so how is it possible to have back 15? Amount of money + velocity.

I want the text of the video here.where to find them? thanks.

The last third of the movie is pretty good though. (Except the bible stuff :))

It's funny to see, how the filmmakers think about taxes and forget, that taxes pay roads, schools, universities, hospitals a.s.o. Overall, there is lots of half wisdom, mixed with conspiracy theories.

What a joke. Let me borrow your car for a couple years no interest. I'll give you what the car cost and you give the same amount back when I'm done. Are you people so stupid not to understand depreciation on capital goods, and the opportunity cost and time value of money, or are these concepts lost on you? And to the couple of Islamists talking about no interest, look at Sharia compliant countries' economies and tell me how great your inept concept of economics is.

The idea that money arose out of a need created by a short coming in barter is not historically verifiable. This documentary relies on way too much economic myth.

Right off the bat I can say tell that this is either not entirely honest or not well researched. Two minutes of looking in books and online tells me that mortgage simply doesn't mean death grip, especially in the sense we understand the phrase. It comes from old french and translates to "dead pledge". "Dead" in this phrase originally referred to the conditions of the death of the contract, not any person involved.

And that's why I'm not going to bother watching the film.

good movie

Everytime the narrator mentions 'welfare SCHEMES' I am made aware that there is an agenda being put forward here. They could be called 'welfare PROGRAMS' as their effect on a certain stratum of society is a very positive one, but they are termed 'SCHEMES'. I see Ron Pauls face and here his heartless brand of INDIVIDUALISM being promoted here. And behind his face, Ayn Rand and that whole wonderfull shit soup she cooked up. Think for yourself, especially when others are thinking a bit too fast for you to keep up. There is an agenda here.

No wonder Islam prohibited Interest 1400 year ago..

They forgot to mention that past attempts to make an interest-free economic system were all thwarted in nefarious ways by the agents of the banking cartel.

can anyone say Federal Reserve System....and "they" will say "let them eat cake"......the question to follow is...do we have enough baskets to hold their severed heads. the masses WILL eventually make right the wrong. and it wont be soon enough.

Very interesting documentary, thanks for linking it to your site. I was quite surprised that despite the dire nature of the topic, the documentary has a few black humour gems that ought to be seen.

The religious references are probably due to when the doc was actually made. I only listened to it and didn't find them too distracting. Great doc. I agree, it should be played in Economics 101.

I am Afghan Canadian interest is also forbidden in Islam but in Afghanistan

there is no interest banking system .

to be honest 95% Afghan people have their own houses.

Excellent.

I look after dogs. I have bartered for most my furniture. I barter with a beautician, a seamstress, i have bartered for olive oil, fish, cakes you name it i,ll barter it. I have worked the bog for three years and bartered my turf for work done to my house Cut out the middle men, cut out the money and get what you can locally. Money only makes money for banks. I have never taken a loan out as it never made sence to me to borrow money i dont have and it never made sence for me that the banks can make more money for themselves off my money.

Thank you from Buzz Knapp-Fisher getting off TOXIC. There is a connection with dirty banking & energy

The religious quotes may just be there to draw the attention of some people more effectively. However it may be noted that in Islam also are interest rates supposed to be forbidden apparently so the author could have added other religious examples too, if he didn't.

I don't particularly believe in the divine and exclusive character of religious texts but it is interesting to see that this money supply issue is as old as that and has been warned of, in one way or another, long before most people even carried bags full of coins or held virtual accounts at the bank... in any case it seems that the prophets were from wealthy families, part of a small elite who were already acquainted with such financial and political issues...

Economics are really complicated. It is impossible to grasp all the dynamics of the system and all agree on the best way to increase people's well being today and the long run...

One thing to remember from this documentary:

- gradual taxation allows a system to reach higher value equilibrium. Poorer people should more easily pay back a loan than richer people. Otherwise, it becomes more difficult for the poorer and easier for the richer = divide increases. This increase in inequality happens because, in the current context, the richer you are the easier it is to make more money (many inequalities: education, parental situation, asymmetry of information). If this abnormal dynamic is not polished in one way or another, it is against Man's interest (a few manage to own and decide over the masses). Well here too some people would disagree (some find it more effective to rely on a few.. blabla, those shall only speak in their names and keep their mathematical ethics for leisure games only)

Don't forget the theory of free competition, of the market economy that is so valued by the western world is based on many assumptions which are not present in our world. It is against the concentration of power and decision for a start. Thus any free economic system and model should find the most efficient ways to perfect those assumptions or prevent their absence from precluding the theoretical gains of free competition. As result, if birth and information inequalities (some people are born rich and live in a rich making micro society where money and information allows unfair comparative advantages over all others) are not and cannot be addressed, there remain many economic state tools such as (gradual) taxation on top of all the anti-trust laws and other state instruments used... and gradual interest rates based on the size of loan and one's wealth?

i agree that the religious quotes seemed of out of place. but in a highly religious society, i can understand how it helps allow people to grasp/accept the concept with a familiar principle in the overall view. to some, morality and ethics don't come intrinsically and to others, religious views are held above all else.

aside from that, this was amazingly informative. hopefully more people can take something from this than those who get hung up on personal perspectives.

The banking stuff is great, however... Although I'm personally a big fan of the big Jesus, the biblical stuff in this video makes it useless for sharing with others who need the important education on banking, but who may be turned off by biblical quotes.

WTF? Whoever made this video severely castrated its usefulness as a teaching tool by making it only suitable for Christian Sunday school classes.

The old testament prohibits Jews charging interest to Jews. Non Jews were fair game for interest. Typical christian selective reading.

Really well done documentary. Just the bible and jesus stuff confused the hell out of me... how does that fit into this? :/

Short, simple and straight to the point.

Brilliant.

Nice documentary. The Government can easily run the banking system and get rid of usury and this would solve many of the problems of boom and bust. There is also a new idea called the Equal Money system... and there are other ideas floating around out there. We need vigorous debate but more importantly we need to sack the privatized centralized banking system(s).